The University also maintains a central capital asset register of equipment costing in excess of £25K. It has to do this because these high value assets are included in the University's financial statements. This register is kept on the finance system (Agresso) and is maintained by the Finance Office. This is why we ask that addition forms and copies of disposal forms for equipment costing initially over £25K be sent to the Finance Office.

Once a year in June or July, in preparation for the annual accounts, this register is checked with departments for verification of accuracy and completeness. For departments, this should be a simple exercise of checking against their own asset registers.

Capitalised equipment is stated at cost, or where donated, at valuation and depreciated, on a straight line basis, as follows:

- general equipment - five years

- furniture - five years

- catering Equipment - seven years three years).

The University Policy regarding depreciation start dates is as follows:

- if the expenditure is on a research project/grant, the depreciation start date is the 1 st August in the financial year of acquisition

- if the expenditure is not on a research project/grant, the depreciation start date in the 1 st August in the financial year after acquisition.

Appendices

Appendix A

Format of Asset Register - an example

Appendix B

A department should set up procedures such that the responsible person is informed when an item has been delivered in order to update the register.

The procedures will vary from department to department. In some cases the person responsible for the register will be the same person who orders the equipment. In other departments the register controller will not necessary know that an item has been purchased and in these cases an internal system will need to be implemented.

One method may be to continue to complete the inventory addition form for items under £25K and for that form to be passed directly to the register controller (the form will no longer be needed in the Finance Office unless in excess of £25K).

Whatever approach is used it would be sensible for the department to document those procedures and circulate as appropriate within the department.

Appendix C

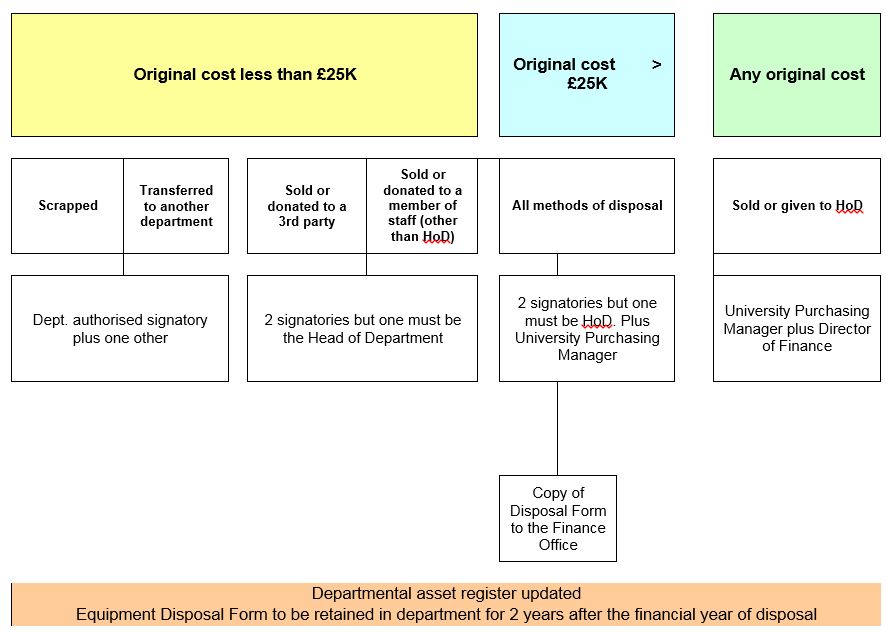

Procedure for disposals - Equipment disposals form